Disposable Infrastructure in an Extractive Age

Google’s Oklahoma Gamble

Tents and Cathedrals

Google just announced a multi-billion dollar AI campus in Oklahoma, bathed in the glow of “renewable” branding.

The site they chose tells another story.

They promise to shore up power and replenish water, but the way they’re doing it gives the game away.

Real infrastructure roots itself in the landscape; it’s meant to endure.

Platforms lease the future quarter by quarter, rolling depreciation schedules over communities as if they were disposable.

Think cathedrals and tent cities: if you mean to stay, you carve stone and raise arches that outlive you. If you plan to pass through, you pitch canvas, quick to raise, quicker to abandon.

This is Rollover Capitalism, the creed that says logistics and ecosystems alike can be run just-in-time and discarded on schedule.

This site reflects that divide: built like a tent, branded like a cathedral. It’s a hedge for the day the bubble bursts.

Let’s follow the money, the water, and the afterlife. From Oklahoma’s brittle data farms, to county landfills, to China’s molten salt reactors, the contrast is already here.

This is a story of permanence and extraction.

The Tell Is in the Dirt

So why Oklahoma?

Google picked it because it’s cheap.

Cheap land. Cheap Incentives. Aquifers that aren’t in open crisis yet. Power transmission you can tap without a fight. Permits that glide through without so much as a raised eyebrow.

On paper it looks like opportunity. In practice it’s the first hedge: set the tent where exit is easy and costs travel well.

Permanent assets ask for permanent ground. Google isn’t laying stone here. It’s staging gear with a shelf life.

The filings spell it out. Tax breaks, water filings, interconnect queues. Each one is a receipt for disposability.

The choice of Oklahoma makes the subtext plain: Google has run the drought math. The basin decides who gets cut when it’s dry. When water runs short, this site is already under the knife.”

Location is the first hedge.

They promise reinvestment. The plan on the table is speed.

The Solar Mirage

Solar wins bids because it’s fast and subsidy-friendly.

Twelve to twenty-four months from dirt to ribbon. Stackable credits that sweeten the math. Vendor financing that front-loads the upside and pushes the tail elsewhere. Photo ops for acres of panels and a headline about “the future.”

When the spreadsheet shifts, the scope shifts. Agile, modular, disposable.

Physics is less flexible.

Panels degrade from the start. Heat, dust, hail, UV, water intrusion, microcracks. It all adds up. The twenty-year warranty is an admission that replacements are part of the plan.

Nameplate capacity looks good on the balance sheet; real capacity shows up at peak demand, exactly when the weather’s worst and the grid’s stressed. A gigawatt on paper isn’t a gigawatt on demand.

Google leans on a policy that rewards speed and ignores durability. Deployment speed gets rewarded. Durability doesn’t. The result is fragility, a race to install fast, claim credits, and leave someone else with the bill.

That’s the tent economy: quick to raise, fragile under stress.

If Google had faith in this site, they’d be building data centers to last.

Solar wins the spreadsheet. But the spreadsheet is not the grid, and the grid is not the society that depends on it.

And when the panels crack and the subsidies expire, what’s left is debris no one wants to own.

The Hidden Waste Stream

Every panel is a promise with a deadline.

On paper it’s twenty to twenty-five years. The warranty admits failure is expected. The mess begins when the output fades.

Behind the glow of clean energy lies a second lifecycle: glass, polymers, lead, cadmium, lithium electrolytes. Every array a stockpile of heavy metals and fragile coatings waiting for the landfill. There are recycling efforts, but they remain costly, fragmented, and small compared to the wave of waste on the horizon. Without strict end-of-life handling, they leach into soil and water.

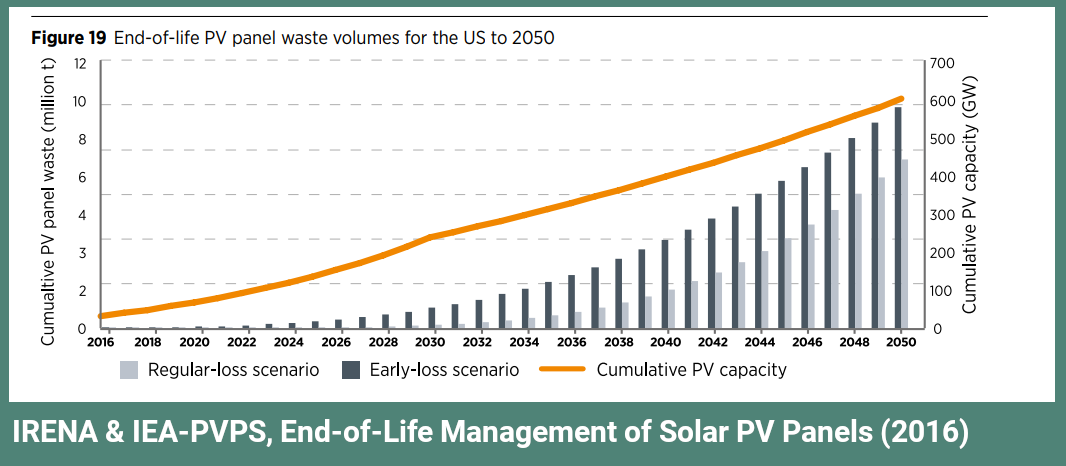

The scale is enormous. By mid-century, projections put solar waste in the tens of millions of tons.

The batteries tied to solar arrays are worse: more toxic, shorter-lived, and just as neglected when the headlines fade.

There’s a pattern to where it all goes. The same rural counties that host the arrays often inherit the waste: disposal sites, “second-life” refurb centers. The burdens of clean energy are not distributed cleanly. They follow the same logic they always have: out of sight, out of city, out of power.

There is no federal program to track this stream from cradle to grave. No funding, no oversight, no long-term stewardship. Just a regulatory vacuum dressed in green branding.

And then comes the quiet second waste stream: water.

Google pledges replenishment and “water-positive” portfolios, promising to replenish what they use, and then some. But when drought hits, the farmers feel it before the data centers. Because water offsets travel. Water rights don’t.

What matters isn’t how much is replenished in aggregate; it’s whether the same aquifer sees it back. Whether the same drought-strained basin gets relief. Whether the community hosting the drawdown ever sees a drop of the return.

And beneath it all runs a third stream: control.

You’ll hear the pitch: energy independence, resilience, local control. Clean power, right at the edge. No more waiting on the grid.

But look past the brochure. Inverters age out in ten to fifteen years. Replacements are specialized. Firmware is proprietary, upgrades locked to the vendor. Batteries degrade just as fast, chained to global supply lines. Energy management stacks hidden behind subscriptions and remote overrides.

What they call resilience comes with a bill and a login screen.

Google is building messes it won’t stay to clean up.

Durable infrastructure endures long after the subsidies are gone.

The Cathedral Standard

Serious infrastructure is built to outlast the hype.

Sixty, eighty years of design life. Capacity factors that don’t collapse when the weather shifts. Maintenance you can plan, not patch. Oversight that belongs to the public.

Google could choose this standard in Oklahoma. It didn’t.

The proof isn’t theoretical. France still supplies most of its electricity from nuclear. Plants raised decades ago, now being extended while new ones are commissioned.

And the next generation is already breaking ground. Abroad, China has revived molten salt reactor designs first tested at Oak Ridge in the 1960s and pushed them further. In June 2024, its prototype in the Gobi Desert reached full operational power. By October, scientists there achieved a world-first: refueling a thorium reactor while it remained online. Commercial-scale versions are planned for the 2030s. While Google hedges with disposable shells, China is building for permanence.

In the United States, advanced projects remain mostly stuck in paperwork and hearings.

Even the waste problem has an answer. Deep geological repositories, once only an engineer’s sketch, are coming online this decade. Every barrel tagged, tracked, sealed, monitored for centuries.

A real grid doesn’t need purity. It needs strength. Nuclear for the floor. Wind and solar for the peaks. Storage for the ramps. HVDC to move it where it’s needed.

We used to build like this.

Hoover Dam poured into bedrock.

Transmission towers striding over mountains.

Projects meant to hold for generations.

The supercomputers inside these centers won’t last. In a few years they’ll be obsolete, swapped for faster ones. But that’s no excuse to build disposable shells. We don’t keep the same cars for forty years, but we still drive on the highways our grandparents did. The machines are temporary. The infrastructure should last.

The AI landlords celebrate “agile” equipment arrays already dated by 2040, while still relying on infrastructure built two generations ago.

They’re not building for longevity. They want to cash the dividends now and leave the bill for the next generation.

The Rollover Playbook

It always starts the same way.

Front-load the money spent. Construction subsidized. Equipment written off. Hold a ribbon-cutting.

Politicians get a photo op. Executives get a write-off. The spreadsheet says net positive, for now.

Then costs come due.

Decommissioning is unfunded. Panel and battery aftercare kicked to the county. Power line upgrades socialized through ratepayer hikes. The cleanup isn’t anyone’s job until it’s everyone’s burden.

And when the numbers shift? So does the plan.

Data center specs rewritten midstream. Load targets revised. AI density demands a redesign.

This is the model working as intended.

Landing Google’s AI campus todayoften means granting a billion‑dollar sweetheart deal. Pennsylvania alone expects its tax-exemption costs to jump from $157 million in 2023 to over $1 billion this year.

The upside is privatized. The risk is spread across local governments with no veto power and no escape clause. And when the hype cycle stalls, what’s left is a half-built shell, a maxed-out substation, and a few miles of grid that don’t serve the locals anymore.

The stop-go cycle is standard now. Social firms pause builds, then resume under new banners. Cloud infrastructure gets gutted and rebuilt for AI. Locals weather the volatility, sold as “resilience.”

Do the math.

Incentives per site often run into the hundreds of millions. Public records and watchdog tallies confirm it. Decommission costs fall between twenty and forty dollars per panel. Add a hundred dollars or more per kilowatt-hour of battery. Add concrete. Add soil remediation.

The net public risk over twenty years lands in the mid nine figures, especially when you count water infrastructure and long-term opportunity cost.

And Google’s exit strategy?

Solar fields can be sold. Re-scoped. Abandoned.

Batteries age out and get scrapped.

The land heals slow, if it heals at all.

This is the same scarcity logic I described in AI Feudalism.

When permanence is avoided, dependency deepens. When the cathedral is never built, the tent becomes a trap.

Reading the Room

The tell is in the calendar, not just Oklahoma’s dirt.

Solar depreciation runs fifteen to twenty years. AI insiders, Altman among them, now predict the bubble strains by 2028–2030. The timelines rhyme.

Corporate incentives follow the same arc: benefits front-loaded, exits baked in.

That’s not coincidence. That’s convergence.

Look at the last cycle. In the 2010s, Meta, Amazon, and Microsoft built campuses meant to stand for decades. Hardened shells. Long-haul fiber. Overbuilt substations. They were betting on expansion.

Google isn’t building like that. Temporary shells. Fast rigs. Specs designed to be swapped midstream. This isn’t how you build when you believe. It’s how you hedge.

You can already hear the pivot language taking shape. “Rescoping.” “Second-life assets.” “Lessons learned.” Narratives crafted for the press release, not the civic ledger.

Google isn’t betting on permanence.

They’re betting on collapse.

And setting themselves up to profit either way.

After the hedge comes the alibi. The same firms that build for collapse argue they had no choice. Nuclear, they say, takes too long, costs too much, drowns in red tape.

The Standard Excuses

The chorus is predictable.

Nuclear takes too long.

Nuclear costs too much.

Nuclear drowns in regulation.

Each objection sounds pressing. They all dissolve under daylight.

Too urgent for nuclear? That’s the reason to start now. Renewables can bridge the near-term load. Panels and turbines buy time. But without stone in the ground, the bridge leads nowhere. The only sane path is parallel: build the quick, begin the permanent.

Cheaper up front? That sticker hides the real bill. It ignores the capacity factor, the lifecycle, the software lock-in. It counts the ribbon-cutting but not the retirement. It underwrites the executive bonus but not the county landfill. Communities don’t pay the headline cost. They pay the tail.

Regulatory burden? That’s not physics. That’s policy failure. Designs can be standardized. Licensing streamlined. Decommissioning bonds required across every technology, not just nuclear. The burden is chosen, not inevitable.

And then comes the smear.

The one meant to end the argument without making one.

Anyone pushing for permanence gets cast as a Luddite, as if wanting assets to last were the same as fearing machines.

But the truth is sharper. Real futurists build for future generations. Day-traders build for payday and a vacation in Aspen.

Google has made its choice clear.

Rules for Permanence

Speculation has rules. Permanence needs different ones.

If we want serious infrastructure, we need policies that force grown-up choices.

Start with bonds.

No project should break ground without covering the cost of its burial. Panels, batteries, concrete, soil, water remediation, all of it paid for up front. Profit on day one means budgeting for day last.

Credits should be tied to delivery, not just installation. Power that lasts for decades, not just a nameplate rating or a one-year burst. The public deserves kilowatts they can count on, not paper megawatts.

Control has to stay local. Open standards for energy management. On-site overrides. No remote-only kill switches for civic infrastructure. If the lights can be turned off from a distant office, the community doesn’t own the asset.

Water must be basin-true. Replenishment in the same watershed. Drought priorities disclosed. Triggers posted for all to see. It doesn’t matter what the spreadsheet says if the aquifer at the fence line runs dry.

Public money should buy public time. Forty years minimum design life to qualify for the richest incentives. Anything less is subsidy for scrap.

And finally, equity. If locals share the upside, they should have the power to veto the shortcuts. Communities are not props for ribbon cuttings. They are shareholders in the future being built on their land.

If we mean to stay, these are the rules.

This is the toolkit of permanence.

The Nuclear Test

Infrastructure is a confession. It tells you what the builders believe about place, time, and whether they plan to be around when the concrete cracks.

We have a choice.

Subsidize speculation, or demand partnership.

Reward speed, or require commitment.

When the AI gold rush fades, and it will, what will Oklahoma inherit?

A civic asset that powers the next generation?

Or a field of broken panels, expired tax credits, and press releases about lessons learned?

The test is simple.

If you mean to stay, you build for decades.

If you mean to pass through, you build for rollover.

What divides the outcomes is the culture we want to be.

Enjoyed this piece?

I do all this writing for free. If you found it helpful, thought-provoking, or just want to toss a coin to your internet philosopher, consider donating $1 to support my work.

Also, Oklahoma is near the bottom in school system rankings. So where are the workers coming from?

Investing in the future would look like investing in schools and workforce development to employ local people and develop local economies.

But hedging for the bubble to burst would look like bringing in trained workers from other places, who have no connection to the communities or the land.

Based on your analysis here, I’d be extremely surprised if Google was in talks with the local school systems or Indigenous peoples.

On the money. This is the type of behavior that ruins small communities, and no corporation is ever held accountable. Regulation at the front is the only option to ensure that these communities can survive and thrive when corporate powers move in to take advantage of their resources.

I do wonder, how well will a solar factory do it tornado alley? Are there safety nets in place for tornadoes or is this yet another oversight?